As technology and societal needs evolve, the health insurance industry is undergoing significant transformations. Future health insurance plans are expected to integrate advanced technologies, personalized coverage, and innovative payment models to better serve policyholders. Here’s an exploration of the key trends and developments shaping the future of health insurance.

The Role of Technology in Health Insurance

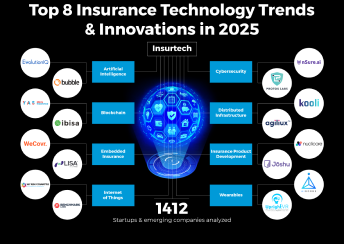

1. Artificial Intelligence (AI) and Big Data

- Personalized Plans: Insurers are leveraging AI to analyze vast amounts of data and create tailored policies based on individual health profiles and risk factors.

- Claims Processing: Automation through AI reduces paperwork and speeds up claim approvals, enhancing customer satisfaction.

- Predictive Analytics: Identifies potential health risks early, allowing for preventive care and cost savings.

2. Telemedicine Integration

- Health insurance plans increasingly cover virtual doctor visits, making healthcare more accessible and convenient.

- Telemedicine reduces the need for in-person visits, cutting costs for both insurers and policyholders.

3. Wearable Technology

- Devices like fitness trackers and smartwatches are becoming integral to insurance plans, offering rewards for healthy behaviors such as exercising or maintaining regular sleep patterns.

Personalized and Flexible Coverage

1. Modular Plans

- Future health insurance may offer modular options, allowing policyholders to select specific coverage elements like mental health, chronic care, or maternity benefits.

2. On-Demand Insurance

- Short-term or temporary health insurance options are gaining traction, providing flexibility for gig workers or individuals in transitional phases.

3. Value-Based Insurance Design (VBID)

- VBID focuses on offering incentives for choosing high-value care options, such as preventive services or chronic disease management programs.

Cost Management Innovations

1. Blockchain Technology

- Ensures secure and transparent transactions, reducing fraud and administrative costs.

2. Direct Primary Care (DPC)

- A subscription-based model where patients pay a flat fee for unlimited access to primary care services, bypassing traditional insurance intermediaries.

3. Health Savings Accounts (HSAs)

- Encourages individuals to save pre-tax dollars for medical expenses, empowering them to manage healthcare costs effectively.

Emphasis on Mental Health Coverage

- Future plans are expected to prioritize mental health services, recognizing the growing awareness and importance of mental well-being.

- Comprehensive mental health coverage, including therapy, counseling, and substance abuse programs, will likely become standard.

Global Trends and Universal Coverage

1. Health Equity Initiatives

- Insurers are addressing disparities in healthcare access by designing plans for underserved communities.

2. Global Health Insurance Plans

- With increased globalization, future plans may offer coverage across multiple countries, catering to frequent travelers and expatriates.

Challenges Facing Future Health Insurance

1. Rising Costs

- While technology improves efficiency, the cost of advanced treatments and medications continues to rise, posing challenges for affordability.

2. Data Privacy and Security

- The integration of AI and wearable devices raises concerns about the security of personal health information.

3. Regulatory Changes

- Evolving government policies and regulations can impact the structure and offerings of health insurance plans.

Final Thoughts

The future of health insurance promises greater accessibility, affordability, and personalization through technological advancements and innovative approaches. By staying informed about these trends, individuals and families can better navigate the evolving landscape and secure coverage that meets their unique needs.